do nonprofits pay taxes on utilities

Nonprofit organizations must apply for exemption with the Comptrollers office and receive exempt status. Enjoy flat rates with no-surprises.

Providing Essential Utility Services During Covid 19 Payments And Relief

Federal and Texas government entities are automatically exempt from applicable taxes.

. A 501c3 operating in Illinois may not have to pay Illinois sales tax and it may exempt from real estate taxes on property it owns. Taxes on money received from an unrelated business activity. Non-profit exemption A qualifying non-profit organization pays no sales tax on the electricity use.

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. For assistance please contact any of the following Hodgson Russ attorneys. However there are some situations where sales tax is not due.

For nonprofits exemption certificates typically require. Indeed it received 435 million in tax refunds. Pepco says the beneficiaries of those refunds were not the companys shareholders but utility customers.

However organizations that have an E number are liable for excise taxes such as the Electricity Excise Tax the Gas. Pepco collected nearly 546 million from customers to cover its income tax bill for the years 2002 through 2004. The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation.

Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing tangible personal property in furtherance of their organizational purposes. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Procedures to Apply for Utility Tax Exemption.

Wheres My Income Tax Refund. 501c3s do not have to pay federal and state income tax. To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to.

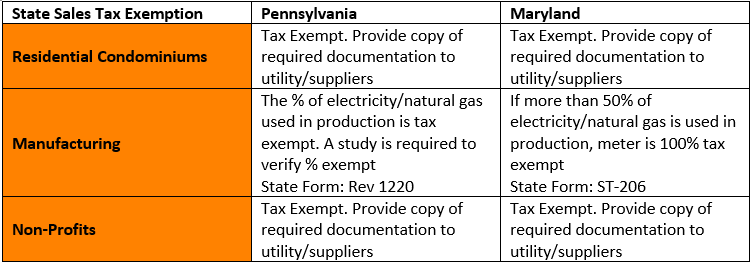

Not the Only Tax-Exempt Entities Government entities also play a critical role in community well-being and also do not pay taxes on the government buildings owned and used by the 67 counties 500 school districts 2562. Pennsylvania Department of Revenue Tax Types Sales Use and Hotel Occupancy Tax Non-Profit. Electricity natural gas cellular phones and telephone is based on reciprocity and is granted upon request and submittal of a completed request of Exemption from Utility Taxes.

Yet the parent Pepco Holdings did not pay income taxes during those years. However this corporate status does not automatically grant exemption from federal income tax. Property TaxRent Rebate Status.

Federal Government State and Local Governments Tribal Governments Nonprofit Organizations Direct Pay Authorization. The Office of Foreign Missions administers the utility tax exemption program. We never bill hourly unlike brick-and-mortar CPAs.

Many Pennsylvania-based nonprofits are not exempt from sales tax and thus pay a state sales tax on purchases made. Even though the federal government awards federal tax-exempt status a state can require additional documentation to. Utility being used directly in the production or service process will qualify for the exemption while utility used for non-production or service processes will be taxable.

DLC must have a copy of the Pennsylvania Sales Tax Exemption certificate and the Pennsylvania Holding Exemption certificate on file if you are claiming status as a non-profit organization. But they do have to pay. Sales to Government and Nonprofits.

Entitys sales tax registration number. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases. Employment taxes on wages paid to employees and.

Most sales of food and beverages to governments are taxable. Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas. The sales tax exemption certificate proves to the seller that the buyer is a legitimate nonprofit and not required to pay sales tax.

The research to determine whether or not sales tax is due lies with the nonprofit. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Nonprofit and Exempt Organizations Purchases and Sales.

It is important to contact each utility in. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on regulated electric natural gas and telecommunication bills. Identifying what portion of utility usage qualifies for the exemption can be difficult thats why SmartSave is here.

House Bill 582 which legislates the tax exemption passed the House 121. As with any tax form each state has its own exemption certificate and requirements. This results in significant savings on monthly utility bills.

Utility tax exemption eg.

Grant Proposal Checklist Template

Free Cash Flow Forecast Templates Smartsheet

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

Houston Utility Assistance Find Help To Pay Your Light Bill 2021

/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)

7 Things You Didn T Know Affect Your Credit Score

Coronavirus Update And Resources Buckley Wa

Tax Exemptions For Energy Nania

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping

Avoid Utility Disconnection 63 Day Exemption In Texas For Medical Needs

Texas Liheap A Utility Assistance Program In Texas For Senior Citizens

Utility Payment Plans Utility Payments And Services Citybase

Catholic Charities Rent Assistance Houston Program To Help With Rent

Revenue Department Clarifies Tax Exempt Sales Notice Alabama Retail Association

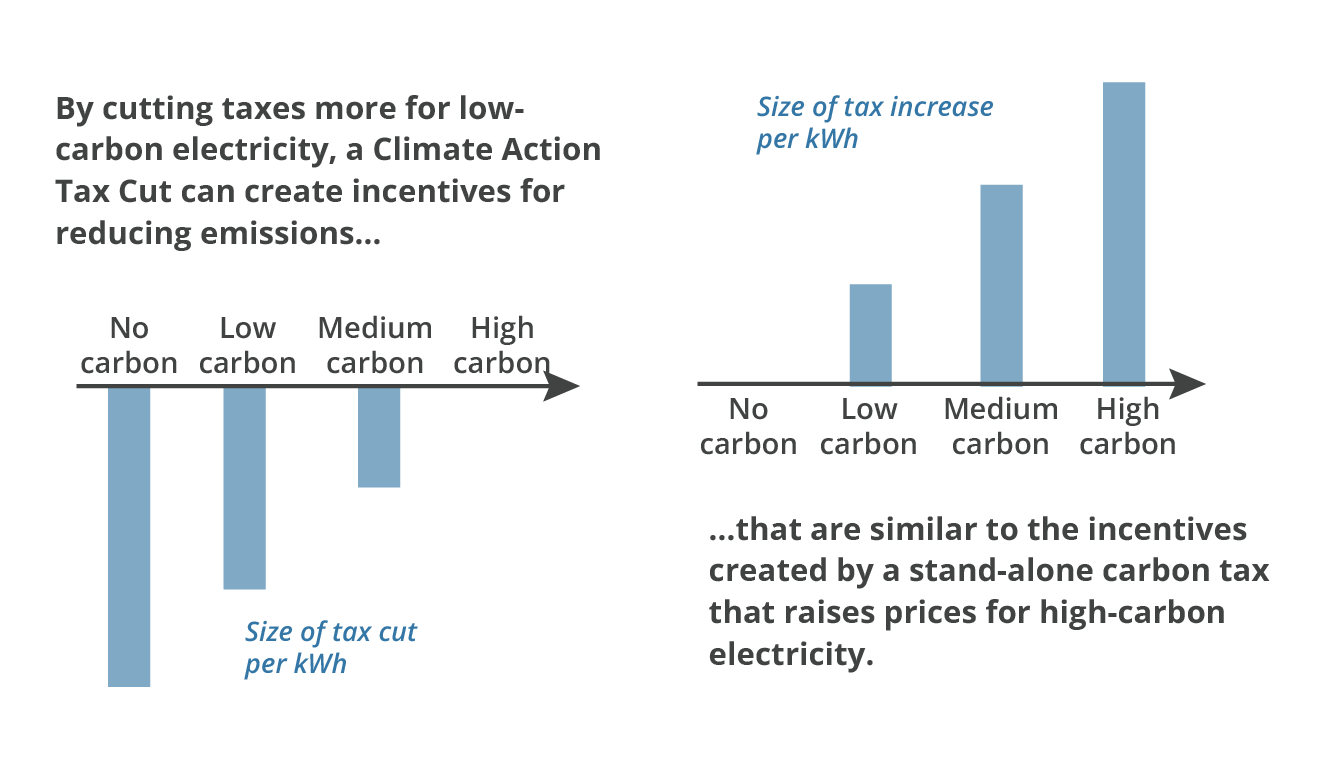

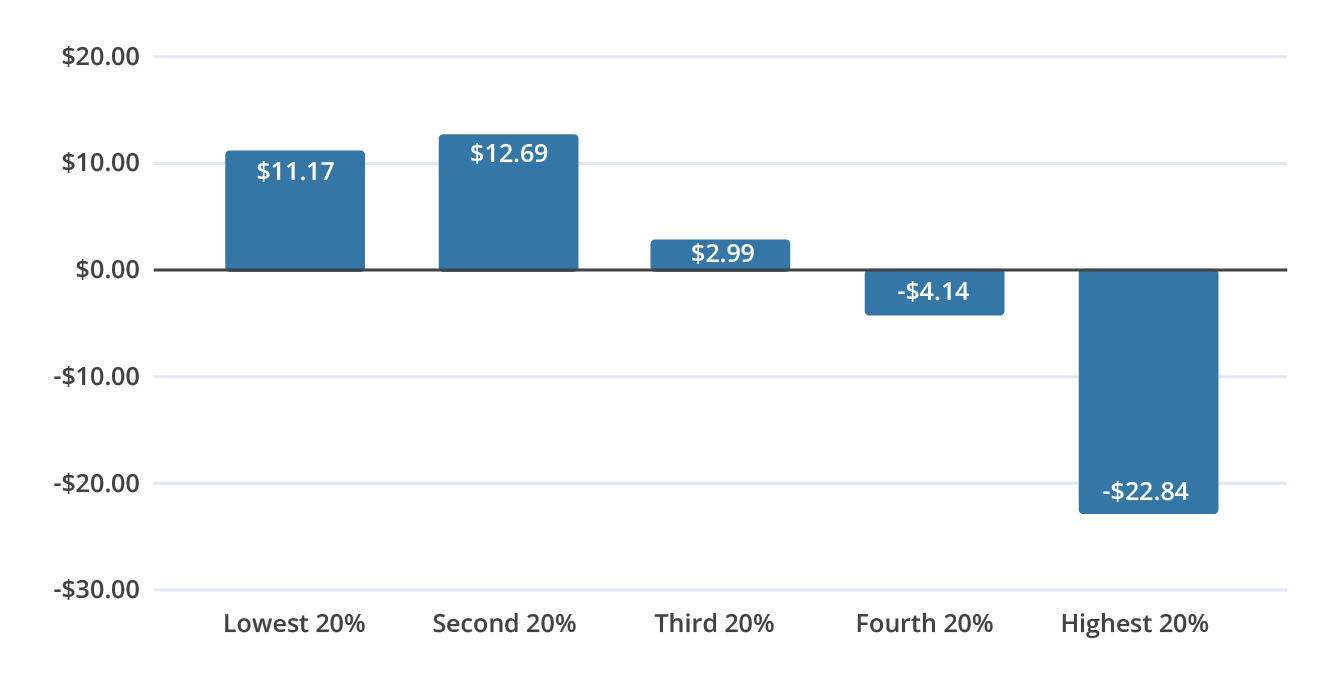

Carbon Taxes Without Tears The Cgo

Tax Exemptions For Energy Nania

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue